Advice For Your Recent College Graduate

During the economic decline of the recession, many households struggled as one or both breadwinners lost jobs. Even workers who managed to survive corporate layoffs suffered through years with little to no salary increases. Unfortunately, these circumstances resulted in reduced savings and many households stopped investing for retirement and college.

This means many children of that era eventually paid their own way through college, racking up loads of debt along the way. Now, upon graduating, they’re starting out adult life “underwater” in terms of their debt-to-income ratio. Among recent college grads (age 21 to 24), 79% have student loans they have to pay back. The average debt burden is $33,000.

That’s a heavy load to carry when trying to climb up a corporate ladder. Rather than focusing on growing wealth or saving to avoid similar predicaments for future generations, the No. 1 goal for 94% of millennials now is to become debt-free. The following are ways to help your recent college graduate find his or her financial footing and develop successful money management habits.

Build Things

One of the first life lessons your college grad may have learned, perhaps while playing with blocks or Legos as a child, is that when building things, you must start with a strong foundation.

Goals

Baseball legend Yogi Berra once said, “If you don’t know where you are going, you might wind up someplace else.” It’s OK if young adults don’t know exactly where they want to end up, but they should know where they want to start. That means finding a job that combines their interests with their skills. From there, it’s a matter of learning to differentiate what they like and want to continue pursuing, and what they want to avoid. Goals beget more goals.

Social Network

This is a skill set in which millennials are likely to shine. They’ve spent much of their youth building broad networks on social media, which they can tap with an open-ended question such as, “Does anyone know of job openings for a tech major?” Or, send a message to a specific friend who works at a desirable company. Thanks to social media, even introverts can have a leg up in this game.

Resumé

When graduates first leave college, their resumés may look like a smorgasbord of oddball summer jobs, volunteer opportunities and collegiate organizations that may or may not have an academic focus. While there’s the age-old catch-22 (can’t get a job without experience; can’t get experience without a job), what’s most important is what they do from that starting point.

As young adults move along the career spectrum, they should look not just for promotion opportunities, but also the ability to diversify their job skills,

experiences in different industries and levels of management as both leaders and individual contributors. This is important because many career paths take lateral turns, and even layoffs. The wider the net of experience, the more potential for earning income during an economic downturn.

Entrench Financial Habits

Spending

Even someone who spends extravagantly can learn to be responsible with money.The trick is to create a budget that accounts for a habit of spending on silly indulgences. The tradeoff is to allocate less money for other expenses — such as housing and utilities, transportation and food, savings and investments.

Splurging on the occasional big purchase can also be balanced out by

practicing inexpensive habits over time. Even a graduate making a remarkable entry-level salary should still make coffee at home and pack a lunch for work most days. Gourmet coffee at Starbucks or dining out in a restaurant (or even the food court) should be a less common indulgence. The advice is simple: “Live like you’re still a college student.”

Saving

Even if only a little bit is set aside each month, it’s not the amount that matters— it’s the habit. An initial goal should be to create an emergency savings fund to cover three to six months of expenses. The second is to pay off debt. Increase payments on the highest-interest loan first. After paying that loan off, add that monthly payment amount to the next highest-interest debt, and so on, until all are paid off. All the while, keep putting away a little each month, even if it’s just $10 in a coffee can. It’s all about entrenching the habit.

Investing

Some young adults mistakenly believe investing is for people further along in their career who are making more money. Nothing could be further from the truth. What normally happens is the older you get, and the more money you make, the more you have to spend it on. In other words, invest while you’re young — before getting married, before taking out a mortgage, before having children. Right out of the college is the best time to start investing.

The younger your grad starts investing, the more money he or she will earn

over the long term, thanks to the power of compound interest. Here’s an

example of how this works:

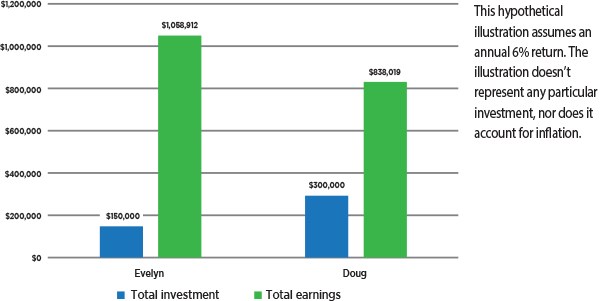

Evelyn starts investing $10,000 a year at age 25 for 15 years, for a total

investment of $150,000. At age 40, she stops investing and reallocates that

money toward paying for her children’s college education.

Doug, on the other hand, spends his money on a brand new car and living it up during his 20s, so he doesn’t start investing until age 35. At that point, he is able to invest $10,000 a year for the next 30 years — twice as long as Evelyn — for contributions totaling $300,000.

Check out how they fare in the chart below.

Despite investing half as much money as Doug, Evelyn earned over $220,000 more by age 65. That is what compound interest can do for a young college graduate who starts saving as early as possible.

The easiest place for young grads to invest is in their workplace retirement plan, where they can take full advantage of any matching contribution offered by their employer.

Protecting

Compound interest works both ways, which is why it’s important young adults don’t miss or make late payments on student loans or any other form of credit. Doing so can trigger penalties and even higher interest rates, amassing a debt that compounds over time. Perhaps most detrimental of all is that any negative reporting will impact credit rating.

A low credit score can make it diffcult-to-impossible to make large-ticket

purchases, such as a car or home. Worse yet, poor credit generates higher interest rates. Those high rates increase how much people owe, making it harder and take longer to pay off debt.5 It’s a vicious cycle that traps many people, and it often starts in young adulthood.

“Tina Fey writes in her book, ‘Bossypants,’ something Lorne Michaels says often at SNL: ‘The show doesn’t go on because it’s ready; it goes on because it’s 11:30.’”

Final Thoughts

Few young adults are completely prepared to enter the workforce, manage their own money and tackle all that life throws at them at such a tender age. And yet, that’s the challenge. You can help by offering patience, understanding and your own pearls of wisdom.

Some of the real-life lessons you’ve learned may come as a surprise to those with less experience. One is that after graduation, few co-workers will care where the new hire went to school, what their major was and certainly not their GPA. Even students who earn a graduate degree will get little credit for it. Respect has to be earned, and for that reason, young workers all start at square one.

Perhaps the most important lesson is to develop good behaviors early. Build a strong foundation and entrench enduring financial habits. Funny enough, one of the most gratifying revelations in parenting is that young college graduates, after years away at college, learn how smart you’ve become.

1 Ryan Jenkins. Inc. Sept. 25, 2018. “This Is the Type of Debt Millennials Have.” https://www.inc.com/ryan-jenkins/this-is-millennials-number-1-life-goal.html. Accessed April 29, 2019.

2 Megan Leonhardt. CNBC. Aug. 16, 2018. “Millennials ages 25-34 have $42,000 in debt, and most of it isn’t from student loans.” https://www.cnbc.com/2018/08/15/millennials-have-42000-in-debt.html. Accessed April 29, 2019.

3 Ryan Jenkins. Inc. Sept. 25, 2018. “This Is the Type of Debt Millennials Have.” https://www.inc.com/ryan-jenkins/this-is-millennials-number-1-life-goal.html. Accessed April 29, 2019.

4 Vanguard Investments. “When should you start saving for retirement?”

https://investor.vanguard.com/retirement/savings/when-to-start. Accessed April 29, 2019.

5 Eric Bank. CardRates.com. May 24, 2018. “3 Reasons to Never Miss a Monthly Payment.” https://www.cardrates.com/advice/3-reasons-to-never-miss-a-monthly-payment/. Accessed April 29, 2019.

6 Frances Bridges. Forbes. April 28, 2018. “The 5 Best Life Tips For College Graduates.” https://www.forbes.com/sites/francesbridges/2018/04/28/the-5-best-life-tips-for-college-graduates/#6fe41b665a83. Accessed April 29, 2019.

7 Jon Youshaei. Forbes. Aug. 2, 2018. “16 Tips Every College Graduate Needs To Hear In 2018.” https://www.forbes.com/sites/jonyoushaei/2018/08/02/16-tips-every-college-graduate-needs-to-hear-in-2018/#c44a2f3 19d3e. Accessed April 29, 2019.

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.