Investor Tips for the New Year

Overview

We approach the new year with indications of a potential economic decline in the near future. Given the continued strength of the economy to date, there are mixed views on when and how severe a possible recession may hit the U.S.

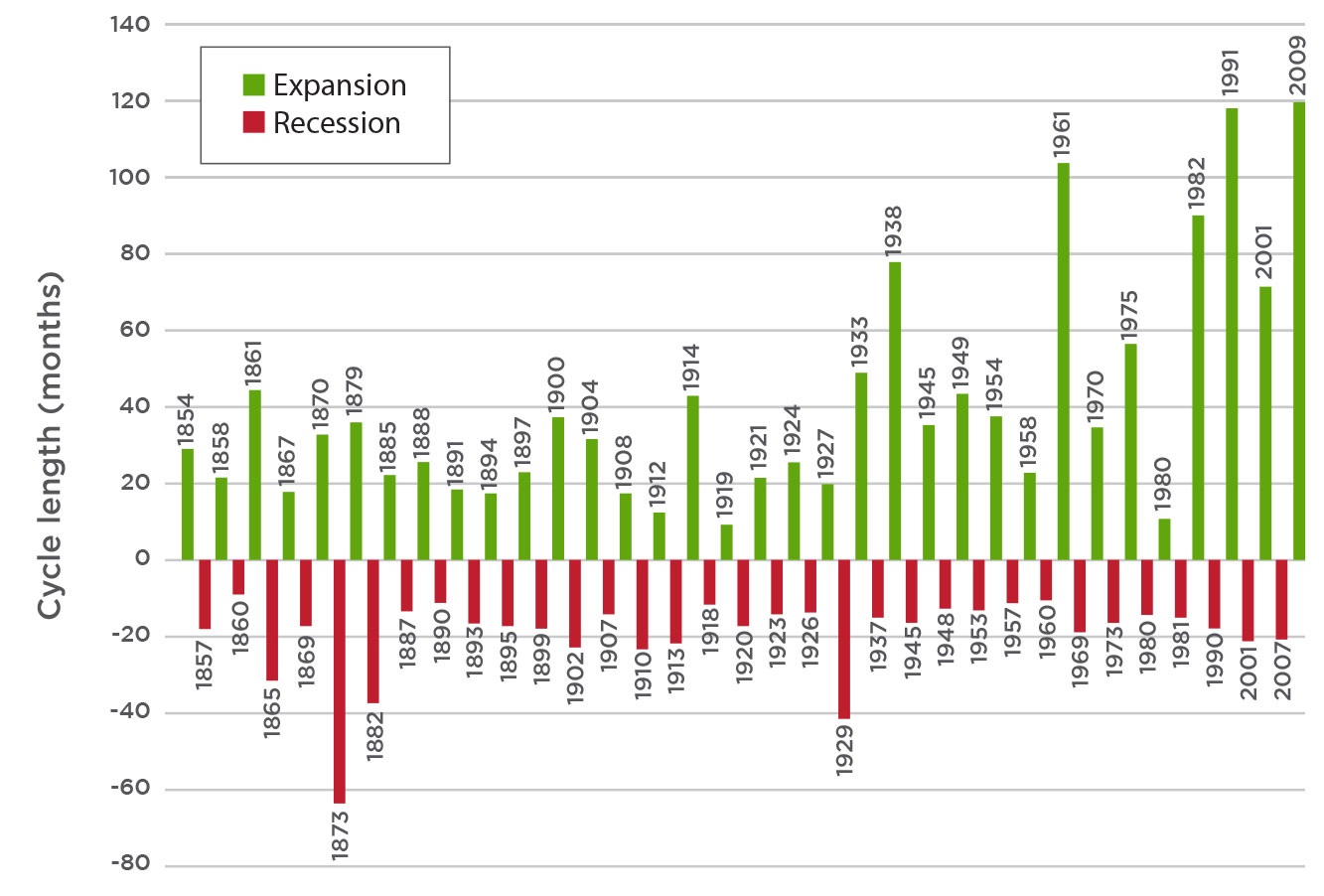

As the accompanying graph demonstrates, it’s perfectly normal for economic cycles to ebb and flow.

History of U.S. Economic Cycles

We’re actually quite overdue for a correction. Notice on the chart that the longest running economic expansions in U.S. history — nearly 10 years each — have occurred over the past 20 years. The expansion that started in 1991 lasted until 2001. There was another expansion that started later in 2001 and lasted until early 2007. Then the recovery that began in 2009 has continued through 2019.

In other words, recent history shows that our growth cycles are getting longer and our economic declines, painful as they may be, are actually relatively shorter and followed by remarkable recoveries.

It’s a good idea to pay attention to what economists and your financial advisor may be cautioning with regard to another decline. Since we tend to start every new year with a fresh batch of resolutions and good intentions, consider developing a strategy designed to both protect your current investment portfolio and accomplish realistic goals to help improve your long-term financial security.

The following are some guidelines to get you started.

Step #1: Assess Your Situation

As we progress toward our financial goals, it’s important to check in

periodically to see where we stand. This is particularly critical since a pending recession could be accompanied by market volatility, and it’s important to strategically position assets to protect recent gains.

One of the first things you should do is calculate your entire net worth. Naturally, this includes the current market value of your investment portfolio, but you also may want to consider:

•The current market value of your home and any other real estate

holdings you own

• The net asset value of any life insurance and/or annuity contracts

you own

• Your credit reports and score if you haven’t done so recently

• How your assets compare to your liabilities to see if you need to step up debt payments

Step #2: Action Plan

You may wish to schedule time with your financial advisor to review your overall financial standing. He or she may recommend specific changes to help protect your current wealth, such as:

• Rebalancing your portfolio to align with your strategic asset allocation

• Repositioning any stock exposure in light of potential market

volatility in 2020

• Repositioning assets earmarked for retirement to create an income stream that’s guaranteed for life by an insurance company

• Increasing automatic investment contributions if you need to be more aggressive about accumulating a retirement nest egg

• Decreasing automatic investment contributions if you need more accessible savings or to pay off debt more aggressively

Strategic Considerations

Asset Relocation

While it may be a good year to reduce your exposure to high-risk assets, recognize it typically isn’t a good idea to cash out of the market completely. Remaining invested regardless of temporary economic declines is one of the key ways to accumulate wealth over time.

Loaning Money To Yourself

During the latest recession, many people stopped or reduced automatic investments in their company retirement plan, and some even borrowed from it. It’s generally a good idea to continue an automatic investment plan, even if you reduce contributions, because it allows your investment to purchase more shares when prices drop, positioning your portfolio for stronger growth opportunity. However, when you go through difficult times, there are scenarios in which it may be better to reduce or stop investing.

Another common mishap can occur when investors borrow from their employer-sponsored retirement account. If you need emergency cash, this is a viable option because it can happen fairly quickly, won’t impact your credit score, there’s no taxable event and you essentially pay yourself back. The problem is, if you lose your job — even if you are laid off due to a recession — you are required to pay back the full loan by the end of the year you left that employer. If you don’t, the unpaid balance will be taxed at your income rate, plus you may be subject to an additional 10% penalty if you are under age 59 ½. This a terrible scenario to be in if you just lost your job.

Insurance Precaution

Conduct a thorough assessment to ensure your insurance coverage matches your current lifestyle. We tend to acquire more things as we age — jewelry, art, fine wine — but over time the total value of our belongings may be worth more than our coverage. Also consider that extreme weather conditions, such as wildfires, floods and hurricanes, put our homes at higher risk than in the past. Take time in this new year to perform a comprehensive insurance inventory with your advisor; you may be able to expand coverage and receive greater value from your premiums by consolidating insurance plans.

Estate Plan Updates

Re-evaluate your estate documents to make sure they still reflect your objectives. When we experience the joy of a new grandchild or the despair of a death in the family, altering an estate plan may not be foremost on our mind. Be sure to update your beneficiary(ies) if you have become divorced, widowed or remarried since you first signed up for a 401(k) plan at your company or a former employer. Make sure all of your various assets are titled correctly. Consider any charitable organizations you may want to have an ongoing relationship with and leave assets to when you pass away.

“Financial planning can be overwhelming, but it doesn’t need to be. Taking small steps and getting an early start will help you conquer whatever financial goals you want to reach in 2020.

Final Thoughts

The year 2020 may be fraught with caution due to the potential for an economic pullback. However, your life won’t exactly be put on hold and you should continue to set forward-thinking goals and actively pursue them. In addition to proactively assessing your finances and implementing any protection plans, consider getting back to basics by:

• Working out a household budget

• Seeing where you can cut back expenses

• Reallocating any savings to shore up an emergency fund

• Sharing financial advice and lessons learned with your children (and

grandchildren)

Your financial advisor has a vested interest in ensuring you meet your goals and will be happy to meet with you to prepare for entry into this new decade.

We wish you a prosperous and happy new year.