Money Management Tools

There’s an app for seemingly every financial transaction or budgetary need consumers have. In fact, there are likely dozens if not hundreds from which to select for each type of activity, from tracking your spending to investing.

Some tools are focused on a particular goal. For example, a micro savings app may automatically transfer small amounts of money from one account to another on a regular basis, while another may round up the total on each of your purchases and redirect the change to a separate savings account.

There are apps that track your credit reports, offering additional tips and information on paying off debt and improving your credit score. There are apps that allow you to invest on the fly, including the purchase of fractional shares to one-millionth of a share.

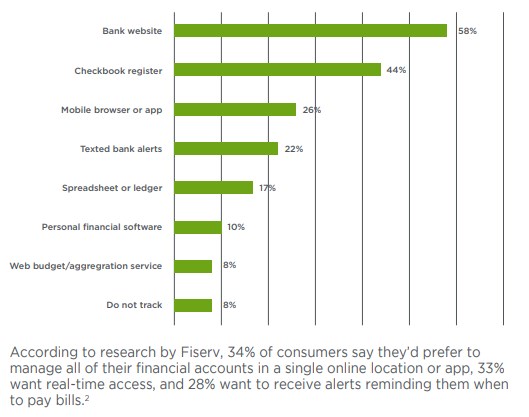

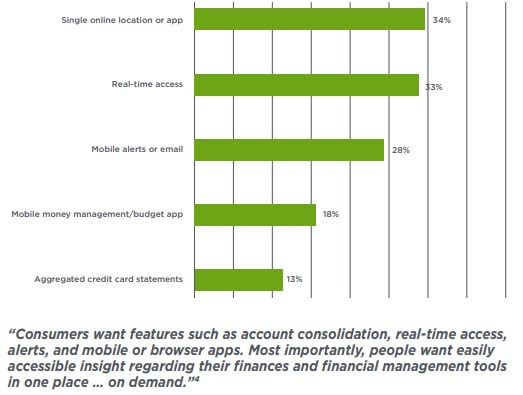

The accompanying graphs show some of the most prevalent consumer tools for managing money.

How Consumers Track Spending

How Consumers Manage Finances

Apps: Budgeting, Saving, Investing and Money Management

As you might imagine, smartphone apps tend to be popular among tech savvy young adults. An entire industry has emerged with start-up companies developing apps to make it convenient and simple for younger, lower income consumers to actively engage in saving and investing efforts. While these apps do a great job of engaging folks at a considerably younger age than in the past, it’s important for people of every age to seek out a basic understanding of budget, debt and money management skills before embarking on an investment strategy — no matter now easy an app makes the process.

With that said, an app can be very helpful when it comes to managing your assets and maintaining a clear and concise big picture of all of your investments through one aggregated dashboard. Bear in mind that there are the free money management apps (albeit paid for by accompanying advertising), apps that charge a fee, and a combination thereof, meaning the basic platform is free but you can pay for premium services.

The following are some popular apps on the market today.

Quicken

Quicken offers a free mobile app as a companion to its computer-based investment and financial management platform. While the app allows users to monitor their investments, it does not offer an option to buy and sell securities.

One of greatest advantages is that the app is integrated with the computer based program so all of your information remains current and at your fingertips — whether you’re at home or on the go.

Personal Capital

Personal Capital’s financial management tools are free and often considered to be on par with Quicken’s paid product. The app enables a user to upload personal financial data to create a variety of reports such as individual account balances, aggregated net worth, customized budgeting tips and investment guidance.

Mint

Mint is a web-based money management platform run by the same parent company (Intuit) that owns Quicken. Popular among small investors and those new to financial management, Mint offers a budgeting platform with income and expense tracking. Mint’s investment platform enables investors to compare their holdings to comparable market benchmarks and view their asset allocations across all accounts. Like most money management apps, Mint offers tips and information, but it is largely geared toward beginning and intermediate users.

Robinhood

Robinhood is a U.S.-based trading platform that currently boasts more than 10 million users. The app hosts a variety of opportunities to generate earnings, including commission-free buying and selling of securities for as little as $1 in fractional shares. It is scheduled to launch an automatic dividend reinvestment plan for investors. Robinhood also offers a cash reserve account that pays a 1.8% annual yield and comes with a Mastercard debit card for easy access to cash via a wide network of ATMs.

Brokerage-Specific Apps

Bear in mind that many investment broker firms offer their own apps to help you manage your individual portfolio on your smartphone or tablet. However, be aware that your Charles Schwab or Fidelity app will not integrate your account information from other investments you may hold, so they’re not a one-stop management tool for a holistic view of your total portfolio.

Websites and Calculators

While apps may be preferred when you’re “on the go,” website tools — which include calculators, investment profile questionnaires, asset allocation recommendations, informative videos, articles, tailored guidance and monitoring functions — provide an excellent opportunity for comprehensive money management within the comfort of your own home. The following are some popular websites and online tools.

Yahoo! Finance

This long-established website offers real-time updates to individual security prices throughout the day. Users can research stocks, create watch lists and set up an account to track all their investments in one place, as well as conduct trades with most U.S. brokers. The website offers a premium service ($34.99/month or $349.99/year) that features exclusive market insights, advanced analytics and more detailed company profiles for a more sophisticated level of personal investment management.

Bankrate

Bankrate has long been a leader in offering a wide array of financial calculators. The website boasts multiple calculators for different needs, including mortgage, home equity, auto, credit card, debt management, savings, investing, insurance, personal finance, college, retirement, tax, loan and small business calculators. For example, you can calculate your payment on any loan or experiment with different inputs to calculate retirement savings.

Dr. Calculator

Drcalculator.com has a wide variety of calculators for savings, investments and loans, including one of the easiest — and most sophisticated — calculators for figuring out how to pay off your mortgage early. Available on both the website and as an app, “Karl’s Mortgage Calculator” enables you to toggle a variety of different payment options to see how they affect your amortization schedule.

Betterment

Betterment is a strictly digital investment company that offers a range of account management services, such as cash reserves (with a fixed rate of return and ATM access) and goal-specific investing (major purchase, college, retirement, etc.).

Challenges

Be advised that in exchange for the convenience of helping you manage your money, these companies in turn collect your personal and financial data for their own needs. While reselling customer lists is one way to create a separate revenue stream, many firms use your data to help develop additional products. They do this by analyzing the specific data users provide, such as what you buy and invest in and how frequently, along with personal information such as age, gender, profession, location, income, credit score and lifestyle habits.

Much of this information can be used to form predictive analysis about your money management skills, reliability and credit worthiness. This helps companies develop more tailored financial management strategies, such as how to avoid debt or optimize savings opportunities.

However, when it comes to financial management tools, one of the biggest concerns is security and privacy. It is important to vet apps and websites before you begin using them to ensure they are reputable and well-regarded by the financial media. In short, explore at will, but be discerning. After all, managing money deserves your full attention.

Final Thoughts

Although you can manage your investments with an app, you may not want to. Electronic tools may be a convenient way to monitor performance, but they may not be an optimal way to manage assets once your investment portfolio becomes more sizable. You still need customized investment advice to help you stay on track and make portfolio adjustments when necessary.

For example, web tools may not be able to tailor advice such as:

• Transitioning investments as you get closer to and during retirement

• Ensuring your investment strategy is tax efficient

• Maximizing Social Security benefits

• Choosing the right Medicare plan

• Preparing for health care costs and the possibility of long-term

care expenses

• Estate planning and protecting your assets via wills and trusts

• Making sure your money lasts as long as you (and your spouse) do

It’s always smart to work with a qualified and experienced financial advisor, especially when it comes to managing assets in preparation for and during retirement. Today’s money management tools make it easier and convenient to acquire information and maintain your investment strategy, so there is ample advantage to combining professional financial advice with day-to-day monitoring and money management tools.