Rebalancing Act: Your Asset Allocation Strategy

Overview

A diversified investment portfolio is generally composed of stocks, bonds and cash instruments. The percentage of how much money to invest in each of these asset classes is referred to as an asset allocation strategy. Strategies are often defined to meet an investor’s goals and tolerance for risk, such as conservative, moderate or aggressive — with variations in between.

An asset allocation strategy helps an investor design a portfolio built to meet his or her investing time horizon, goals and comfort with risk,as well as have funds available for unexpected expenses.

Diversification

Note that asset allocation is not the same thing as portfolio diversification; not exactly. You can choose to diversify your assets across a range of asset classes based on your financial profile. However, choosing to put 100% of your assets into stocks also constitutes an asset allocation strategy —albeit a higher risk one.

The key is to allocate your funds strategically among asset classes to match your long-term goals. For a young person earning a substantial income, a high equity allocation may be appropriate even if his or her portfolio isn’t widely diversified. However, to weather turbulent markets such as the ones we’ve experienced recently, some form of diversification across asset classes, with periodic rebalancing, is generally good advice.

Asset Mix

As a general rule, risk-averse investors are more inclined to hold “safer” assets, such as Treasury bills, high-quality bonds, money market funds and certificates of deposit. Investors who are more comfortable taking risk and have a longer time horizon to invest tend to hold a greater percentage of stocks. Stocks are more likely to experience short-term price swings but offer the potential for higher long-term growth.

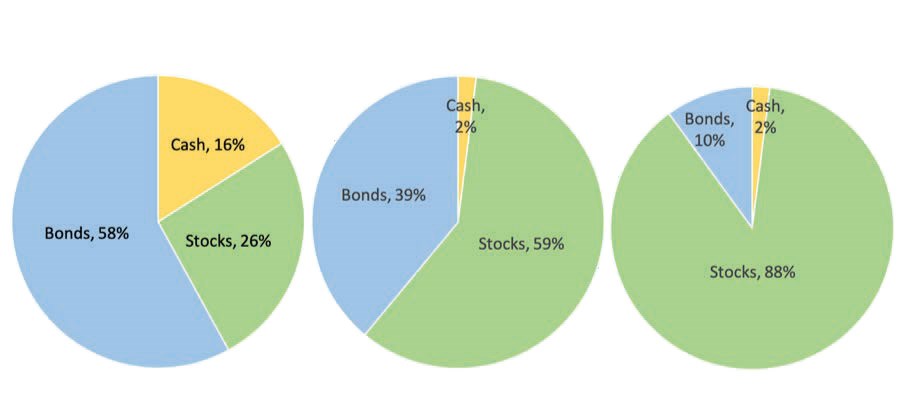

Sample Asset Allocation Portfolios

On the risk-reward spectrum, cash sits at the bottom, bonds in the middle and stocks represent riskier investments but offer higher opportunity for growth. By spreading money across all three asset categories in strategic percentages, an investor can invest for long-term growth while hedging his or her risk of loss. It is generally recommended to base an asset allocation strategy on factors such as age, tolerance for market risk and the amount of money needed to meet goals.

Why Rebalance?

Over time, your portfolio will experience the ripples and waves of nearly every kind of economic cycle, giving each investment category a chance to shine. However, because markets tend to rise and fall without regard to investor objectives, the percentages allocated to specific asset classes, over time, may no longer represent the original designations.

During a bull market, your portfolio could become more heavily weighted toward equities than you’d like and less so in bonds and cash. Because equities tend to be the riskiest of these three asset types, this could leave you exposed to more risk than you’re comfortable with. And the opposite is also true: In a period when bonds are performing well, you could be less exposed to the longterm growth that equities have historically provided.

Rebalancing is the strategy of periodically moving money between asset categories to revert back to the original allocation best suited for your goals. This means paring back in asset categories that represent a larger portion of your portfolio and reinvesting that money in other asset categories that may have dropped.

Your asset allocation should reflect your individual goals and investment style regardless of whether the market is rising or declining. Rebalancing your asset allocation assures that you remain a disciplined investor with a long-term outlook.

“Rebalancing is about returning to your roadmap. It starts with having that strategic long-term plan in place, and then being disciplined about maintaining it.”

Rebalancing Strategies

There are a few different strategies when it comes to rebalancing your portfolio. For example, periodic rebalancing involves monitoring your portfolio to determine when it has diverged too far from your preset strategy and making any necessary adjustments. Regular rebalancing, on the other hand, usually involves setting up an automatic mechanism to rebalance your portfolio on a regular time schedule, such as quarterly, biannually or once a year.

Another way to adjust your portfolio is to follow a “tolerance band rebalancing” strategy. This approach requires that you adjust your portfolio every time an asset rises or falls outside of an acceptable range that you establish, such as an increase or decrease of more than 5%.

Tax Ramifications

Retirement accounts typically offer the advantage of being able to transfer money from one asset class to another without incurring capital gains taxes.Taxes are deferred until you actually withdraw money, generally during retirement. This makes it easy to rebalance without triggering any tax burden.

However, if you need to rebalance a nonretirement portfolio, then you should be particularly aware of tax ramifications and transaction costs. To circumvent these expenses, you can apply three strategies:

- Be reluctant about selling short-term holdings. Capital gains on investments held less than 12 months can be taxed at the highest rate.

- Try to match losses against gains by selling off some losers as well as winners to offset your tax liability with deductible capital losses. Just be sure not to buy back any securities sold within a 30-day period or you’ll forfeit your deduction due to the wash-sale rule.

- Use new contributions to bolster your lagging allocations. This way you can achieve your original asset allocation without actually having to rebalance and incur capital gains taxes.

The Risk of Not Rebalancing

The risk of not rebalancing, especially during a bull market, is exemplified by what we’ve seen in recent months. Up until this year, investors benefited from the longest-running bull market in history (2009-2019). It’s tempting not to sell and rebalance your portfolio when equities continue to rise.

However, many investors who did not take those profits and reinvest them in lower-risk holdings prior to the pandemic crash may have lost a lot of those “paper gains.” After all, money invested in the securities markets is not actually yours until you cash out.

If you don’t periodically rebalance your portfolio to its original percentages,several things can happen:

- You expose your portfolio to excess risk with holdings priced at the top of the market.

- These holdings provide less upside potential.

- You miss out on buying opportunities in market sectors where prices are low.

- You reduce your portfolio’s opportunity for greater longer-term performance.

- Your portfolio isn’t well diversified.

- You run the risk of not meeting financial objectives because you’re no longer pursuing the asset allocation designed to achieve those goals.

Final Thoughts

As investors near retirement, the traditional strategy has been to move growth-seeking investments to more conservative fixed-income investments. This worked fine back when retirement was only expected to last five to 10 years.

But these days, people are living longer. It’s not unusual for someone retiring at age 65 to live to age 90 or longer — which means making a nest egg last potentially 25 to 30 years. This new challenge has initiated more interest in lifetime annuity products.

Therefore, allocating a percentage of a retirement portfolio to annuities, based on your risk profile, may generate income for a longer period of time and with a lower probability of depleting the entire investment portfolio. It also reduces the need to rebalance securities allocations for an entire portfolio.

Given recent market and economic events, it may be a good idea to consider if an annuity would be suitable for your circumstances to guarantee income for your long-term financial independence. As always, we recommend investors consult with an experienced financial professional to determine an appropriate strategy for their particular situation.