1st Quarter 2020

A HISTORIC QUARTER

The first quarter of 2020 started favorably. In early January, the news centered around politics, with the House sending articles of impeachment to the Senate and the Democratic presidential primary process gearing up. Markets seemed confident that President Donald Trump would be acquitted and responded by climbing to new highs. The economy was humming along, and we passed both the U.S.- Mexico-Canada Agreement (USMCA) and a Phase 1 trade agreement with China.

As predicted, the Senate acquitted President Trump of all charges and markets set new highs, factoring in a Trump re-election largely resulting from a strong economy. However, concerns of a virus disrupting commerce in China began to emerge, with companies such as Apple warning that their supply chains could be potentially disrupted. Markets shrugged off the news and continued climbing higher.

Markets finally started paying attention on Jan. 23, when China announced it was locking down Wuhan, the initial epicenter of the virus. In response, the U.S. banned travel from Wuhan and later all of China. Reports emerged that the virus had begun to spread to Europe and was making its way to the U.S. Panic slowly started to set in, both for American citizens and the markets.

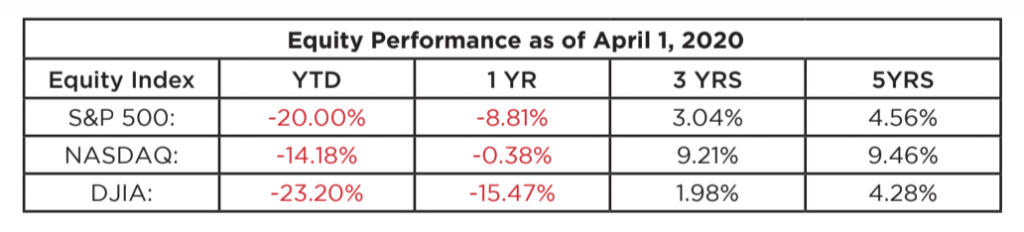

Saudi Arabia compounded problems by making a move to capture additional market share from Russia by lowering the price of oil. The combination of virus and oil war overwhelmed the markets, which began to fall in mid-February and lasted well into March. In total, markets plunged close to 30%, the worst drop since the fourth quarter of 1987.

While markets rebounded some, Q1 2020 was the worst quarter on record since the fourth quarter of 2008.

CORONAVIRUS IMPACTS U.S. ECONOMY

As the novel coronavirus spread across the globe, the U.S. extended travel bans to China and Europe and closed the Canadian and Mexican borders. By early March, universities and K-12 schools shut down and local governments began asking citizens across the country to “shelter in place.” The moves were necessary to slow down the spread of the virus but brought the U.S. economy to a standstill.

President Trump, Congress and the Federal Reserve quickly took unprecedented action to provide relief for individuals and businesses. Markets jumped quickly in response, moving us out of bear territory but still maintaining below previous highs.

As we begin the second quarter, uncertainty abounds. We are still working to contain the spread of the virus, and President Trump has extended stay-at-home guidelines until April 30, putting June 1 as a more realistic date for a restart. Experts believe it could still be a few weeks until we see a peak in virus cases and deaths.

There is good news, however. The U.S. economy was in great shape leading up to these events, and we should recover quickly if the country opens back up in the next few months. The U.S. government has taken fast action to help keep individuals and businesses afloat, and the Federal Reserve has flooded markets with liquidity and pledged to backstop loans.

WHAT LIES AHEAD

Overall, we saw both ends of the spectrum in Q1, with a fantastic start and an awful finish. We know that the economy and the markets will eventually recover – history shows us they always do. We will be wiser and stronger because of recent events. The second quarter will be a challenging one, but we look for good news to start emerging, setting us on a path toward strong growth as we head into the second half of the year.

What steps can you take as we patiently wait for the recovery to begin? First, stay informed. Keep up with the news while maintaining perspective. This is not the first time that markets have dropped, and it certainly won’t be the last.

Second, review your financial plan to make sure you’re still on track to meet your goals. Do not make changes to your financial plan based on emotions; instead, approach your plan objectively, logically and without fear.

Finally, get support. If you need to create or adjust your financial plan, find a financial professional who can help you on your financial journey.

Listen to Chief Investment Officer Tom Siomades talk about the events of Quarter 1 here.