Investing For Income

OVERVIEW

Investing for income is generally the modus operandi of a retirement portfolio. That’s because the so-called “accumulation phase” ends and the “distribution phase” begins. In other words, retirees stop focusing on getting rich and become more concerned with paying their bills and living a comfortable lifestyle.

Income investing is different from growth investing but should still practice a similar strategy of diversification. The goal is to develop two or more streams of passive income so you can retire from work and let your portfolio supplement other forms of reliable income, such as Social Security and a pension.

By building a strategic income-oriented portfolio, retirees can draw a steady stream of income without having to liquidate a large portion of their assets. Through due diligence, risk management, conservative spending and a bit of luck from the stock market, retirees may have funds left over to serve as an inheritance and their legacy.

INCOME EXPECTATIONS

The first rule of developing an income portfolio is to manage your expectations. This requires understanding your needs. Carefully draw up a budget of how much annual income you will need over time, taking into consideration that most retirees have higher expenses during the first stage of retirement when they indulge in travel, projects and other lifelong dreams. The middle stage of retirement is generally the most conservative in terms of spending, while the latter stage typically experiences an increase in health care and long-term care expenses.

The goal, of course, is to not run out of money. Traditionally, financial consultants have advised withdrawing no more than 4% of portfolio assets each year for income.

To illustrate, let’s consider a hypothetical example: Assume that by the time Karen retires at age 65, she has managed to save $350,000. She did this as a schoolteacher, saving $146 a month in a retirement account that grew at an average annual rate of 7% over her 40-year career. Starting at age 65, she is able to withdraw $14,000 a year ($1,166 per month, pre-tax) for at least 25 years.

MULTIPLE INCOME STREAMS

The optimum retirement strategy is to develop multiple passive income streams. This spreads out your risk so that if one income stream runs into trouble, you still have others to rely on. Even in retirement, it’s not a good idea to put all of your eggs in one basket.

For example, the average retiree in 2020 draws close to $1,500 per month in Social Security benefits. Combined, a couple averages about $2,500 a month.2 If you were to supplement those benefits with a $1,166 per month withdrawal from an income-oriented portfolio, that would yield nearly $44,000 in annual pre-tax income.

That additional income might come from a variety of sources, including pension benefits, annual required minimum distributions (RMDs) from a retirement investment portfolio and/or issuer-guaranteed annuity payouts.

INCOME INVESTMENTS

The following are investments typically found in a retiree portfolio. They are known to yield reliable income over time, generally with very low risk.

Bonds

Bonds are less speculative than stocks, because they are basically loans made to public companies and federal, state and local governments. A bond is guaranteed by the debtor to pay out interest income over a specific period of time, referred to as the maturity date. While bonds are considered less risky than stocks, they also generate a lower return on investment. The total return on a bond is the combination of the original principal plus the interest income paid out over time. Retirees can spread out their risk of borrower default and avoid high minimums by investing bond funds, which place money in a wide range of entities and pay out a collective yield to fund investors.

Dividend Stocks

Dividend stocks are considered lower risk compared to other stocks, and they pay out high yields to investors. These tend to be well-established, high-quality “blue chip” corporations with a long track record for dividend growth. The total return of a dividend stock consists of long-term capital appreciation and consistent income. One of the key tenets of these stocks is that they are known to continue paying dividends even during a crisis or economic decline. Here, too, retirees can invest in index funds or exchange-traded funds that hold dividend stocks in order to diversify market risk.

Real Estate

Another income-producing investment is real estate. This can include buying a property and renting it for income, or investing in publicly traded real estate stocks. One way to consolidate these types of securities is by investing in a real estate investment trust (REIT), which combines companies that own commercial real estate, such as office buildings, retail spaces, apartments and hotels. REITs benefit from favorable tax treatment because they distribute nearly all net income to shareholders. This is designed to create a reliable stream of income from a wide range of entities.

Income Annuity

One way to avoid the uncertainty of stock market volatility is to use a portion of retirement assets to purchase an income annuity. An annuity is an insurance contract between you and the carrier. In exchange for a premium payment or series of payments, the insurance company promises to provide you, at some time in the future, with a series of income payments. The guarantees are backed by the financial strength of the insurance company. There is even the option to receive income for the lifetime of both spouses, no matter how long either of them lives.

Bank Accounts

Bank-insured accounts provide another safe income-producing option for a retiree portfolio.

Bank accounts, such as high-yield savings accounts and certificates of deposit (CDs) are guaranteed by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per bank and per ownership category. In other words, a savings account and a self-directed IRA each are insured up to $250,000 at the same bank.3 While bank products are arguably the safest option for a retirement portfolio, they offer the lowest yield. For example, a typical high-yield savings account currently earns about 1.5% annual percentage yield, while a one-year CD offers about 2% in potential income at current rates.

“The art of good income investing is putting together a collection of assets such as stocks, bonds, mutual funds and real estate that will generate the highest possible annual income at the lowest possible risk.”

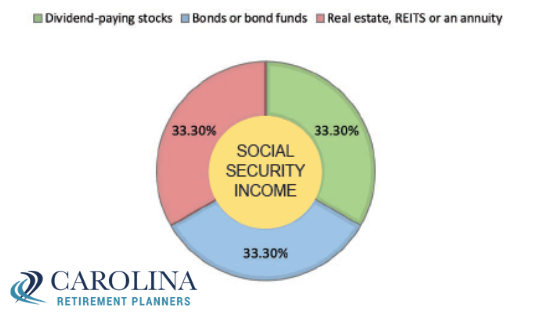

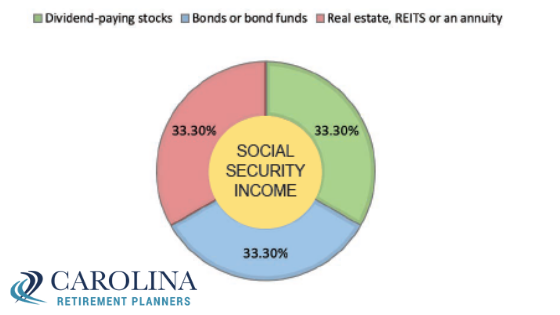

Income Asset Allocation

Just as you would with a growth-oriented portfolio, it is important to assemble a strategic mix of assets in a retirement portfolio designed to produce multiple income streams. This, however, should be determined in consultation with an experienced advisor and based on your income requirements, risk tolerance and how long you expect to need income.

The following is a hypothetical retirement income investment allocation:

FINAL THOUGHTS

Remember that there is a big difference between a growth portfolio and an income portfolio. As investors grow closer to retirement, they should begin transferring assets to more conservative holdings in an effort to preserve investment gains achieved during the accumulation phase. As we have recently witnessed, once again, a sudden and significant market decline can reduce a retiree’s principal to the point where he has less base from which to withdraw income over a long retirement. This could result in running out of money too soon.

The key to building a broadly diversified income investing portfolio is to generate reliable income streams that are not likely to be impacted by the vagaries of stock market performance. In addition to ongoing income, it is critical for retirees to maintain a liquid savings account for emergency expenses.

Transitioning from a growth to income portfolio requires careful planning and analysis. It should be conducted in stages so that gains are preserved and, if necessary, have time to recover from temporary market losses. Consult with an experienced financial advisor to discuss the best way to invest for income for your particular circumstances.