Financial Lessons From the "FIRE" Movement

Overview

The message in today’s news and financial media is loud and clear: We are living longer, so we must work longer to save more.

However, not everyone is on board with that edict. Many millennials have grabbed hold of an idea detailed in a 1992 bestseller by Vicki Robin and Joe Dominguez, titled “Your Money or Your Life.” The basic premise is that by adopting a mindset of thriftiness and flexibility, people can avoid working during the healthiest years of their lives, achieve financial independence and retire early.

It’s called the FIRE movement, an acronym that stands for “financial independence, retire early.” FIRE is a lifestyle system characterized by saving 50 percent or more of one’s income. This type of saver isn’t looking to earn more so he can spend more on things like a nice car, a big house, digital toys or sending his children to a fancy private school. Rather, saving half of his income is the minimum mandate.

The maximum is to achieve happiness and a sense of accomplishment and well-being by deploying smart strategies to optimize the money the FIRE devotee earns. FIRE planners save and build wealth through investing and leveraging assets to provide for daily needs. The key to catching FIRE is to rethink your relationship with money toward a singular goal: achieving financial independence.

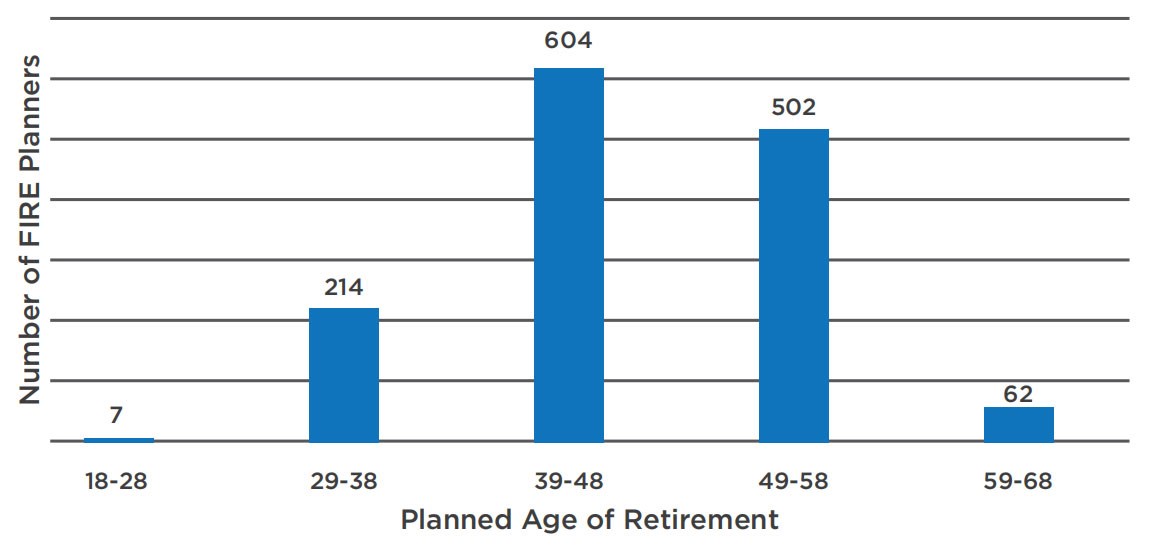

FIRE Devotees: Planned Age of Retirement

According to the Initial r/Financial Independence 2018 survey, of the nearly 1,500 respondents, the largest group planned to retire in their 40s.

Financial Lessons

Obviously, anyone intent on saving 50 percent of their earnings must live well beneath their means. Below are tips to help accomplish this, but first it’s worth exploring a couple of practical tactics that set the stage for mindful money management.

The first is to use a work-cost calculation for every bit of discretionary spending. The phrase coined by author Vicki Robin is to convert dollars into “hours of life energy.” In other words, if you earn $300 a day and want to buy a $150 pair of AirPods, ask yourself if those earbuds are really worth one-half of a day of your precious time left on Earth. Every purchase, whether a Starbucks coffee or a glass of wine while dining out, should be scrutinized in terms of how much it is truly worth to you.

By prioritizing your spending habits within the context of potential financial freedom, it is much easier to “resist” and save that money on a disciplined and daily basis.

Second, the FIRE philosophy takes work. Part of that work is tracking every dollar you spend. Much like some dieters keep a journal of what they eat each day, a FIRE planner records where every dollar goes. This provides a holistic picture that can help you evaluate both your success and your priorities. If you’re not saving half your salary each month, take a look at where it’s going. Fortunately, in today’s digital world, it’s easier than ever to track spending via any number of free smartphone apps.

Here are some tips on how to adopt a FIRE lifestyle, no matter what your age.

Savings First, Then Expenses.

This habit follows the automatic investment strategy often referred to as “pay yourself first.” However, the FIRE version goes a bit further. With every paycheck, you put half the money in a savings or investment account and force yourself to live on the amount left over. If you invest wisely, there will come a day when the interest yielded by your portfolio exceeds your daily needs, at which point you can retire.

Buy What You Need — And Nothing Else

This mindset puts an end to discretionary spending. No more window or online shopping. Replace “retail therapy” with some other coping mechanism, like taking a walk. By buying only what you need and actually use, you require less money to sustain your lifestyle, including less to maintain, repair or insure. The following are ways to avoid spending that people of any age can do:

• Borrow books and DVDs from the public library.

• Shop thrift stores or garage sales before buying something new.

• Borrow clothes from friends for a single-use occasion, such as a

wedding or ski trip.

• Develop an artful skill you can use to make thoughtful gifts, such as photography, growing plants, sketching notecards or writing limericks.

• If someone wants to buy you a gift, suggest a gift card.

Transform Entertainment

An important tactic for maintaining the FIRE lifestyle is to hang with like-minded friends. If your social group has expensive tastes, you’ll spend more than just time with them. Because we tend to socialize with food and drinks, you may not be able to save unless your friends are inclined to entertain on the cheap, such as potluck dinners and picnics. Also, replace expensive outings with free activities indigenous to your area, such as free movies or concerts in the park, museums with free-admission days, hiking and riding (thrift shop) bikes. Check out lectures and programs at your public library and recreation center; audit local college classes; establish a game night with friends.

DIY Your Life

An important element of financial independence is self reliance. In other words, learn how to do things you might otherwise pay for. This includes maintaining your yard, cleaning your house, taking your lunch to work, reciprocating rides to the airport with friends and exchanging pet sitting services. On top of that, learn to fix and maintain things yourself, such as changing your oil or repairing a leaky faucet. Bear in mind that you can learn virtually anything at YouTube.com. At the very least, you’ll learn the difference between an easy fix and when to call a professional.

Housing

A house is an asset, so when you think about buying real estate, think income. Consider purchasing a duplex, triplex or quadplex, in which you live in one unit and let your tenants cover your mortgage payments. This may not be plausible in expensive areas such as New York City or Los Angeles, but consider that you’re not likely to adhere to the FIRE system if your housing costs more than 50 percent of your income.

Children: Spend Time, Not Money

Frequently, the thriftiest couples lose sight of their savings goals once they have children. While many FIRE devotees do not plan to have children, there are ways to cut costs if you do have them. Again, it’s part of a mindset: Spend time with your children, not money. If you start this philosophy as a family practice when they are young, it will help mitigate issues later. Teach your kids and grandkids the same strategies you employ: Buy designer clothes at resale or consignment stores, swap clothes among friends for special occasions, make camping the family vacation of choice and teach your children to use the work-cost conversion calculation when they covet a particular item.

“There’s another generation — hallelujah — that’s adopting these values!”

– Vicki Robin, author of “Your Money or Your Life”

Final Thoughts

In the end, the ability to achieve financial independence and retire early comes down to how committed you are. The lifestyle may be considerably more modest than how you were raised, but there are plenty of advantages. From living a healthier lifestyle to pushing the boundaries of creativity and resourcefulness, you will develop skills that serve you through all walks of life — particularly during an economic downturn.

Even if retiring at a young age isn’t necessarily your goal — or if you are already retired — there are still lots of practical tips to take from FIRE to help you save and manage your money.