Stimulus, Part III: The Plan to Rescue America

Overview

In early March, President Joe Biden signed into law the third round of economic stimulus legislation passed by Congress, authorizing the largest cash infusion yet. With widespread distribution of the coronavirus vaccination in our crosshairs, this “American Rescue Plan” stimulus package is designed to jumpstart the economy at the tail end of the pandemic.

Stimulus Checks

The most noteworthy provision in the new bill is the larger payout to taxpayers, which is designed to boost consumerism from the bottom up. Out-of-work Americans will be able to use the stimulus to help put food on the table and pay bills, which not only helps their situation but also puts immediate cash into the consumer staples sector. Working taxpayers not suffering financially may boost spending in consumer discretionary categories. Still others are likely to save or invest their stimulus windfall, which will serve to strengthen their household safety net or flow capital into companies for greater expansion and job development.

Eligible recipients include those with a Social Security number who earn below a certain income threshold, based on adjusted gross income (AGI) reported on their most recently filed tax return.1

- Individual filers, $75,000 or less, receive $1,400

- Head-of-household filers, $112,500 or less, receive $1,400

- Married joint filers, $150,000 or less, receive $2,800

Taxpayers with qualifying dependents receive an additional $1,400 per dependent, including college students, disabled and elderly adults. Taxpayers earning slightly over those thresholds may receive a reduced amount, with phaseout limits at:2

- $80,000 for single filers

- $120,000 for head-of-household filers

- $160,000 for married joint filers

Child-Related Credits3

The new legislation alters the Child Tax Credit (CTC) as well. The CTC amount was formerly $2,000 for each qualified child (under age 17), of which up to $1,400 was refundable. The credit was phased out at $200,000 for single filers and $400,000 for joint filers. Under the new stimulus act, the CTC increased to $3,600 per qualified child under age 6 and $3,000 for ages 6 to 17, and it is now fully refundable. Phaseout begins at lower levels of $75,000 AGI for single filers and $150,000 for joint filers, but some higher-income families can still claim the original $2,000 credit subject to prior phaseout rules. The IRS reports it will begin making advance payments of the CTC in July, so parents can benefit from it this year.

The new law increases the dependent care credit this year to $4,000 for one child and $8,000 for two or more children. It is available to taxpayers with an AGI of up to $125,000, although a 20% reduced credit is still available for those earning more than $400,000 a year. This credit also will be refundable in 2021.

Another provision of the bill created a tax exemption for student debt that is forgiven. This means that in the future, if legislation is passed or student loan companies are somehow motivated, student loan amounts that are forgiven will not be counted as taxable income. This new tax exemption applies to all student loans, whether insured or guaranteed by federal or state governments, or issued by private lenders and educational institutions. It will not apply to loans discharged in exchange for services. The provision is scheduled to remain in effect until 2026.

Other Beneficiaries

The American Rescue Act also includes the following funding for other beneficiaries:

Schools — $126 billion to safely reopen K-12 schools and make up for lost learning during the pandemic. Direct grants of up to $40 billion will go to support higher education institutions, including public and nonprofit colleges, universities and vocational schools.4

Small businesses — $50 billion, focused on distribution to the smallest businesses. Note that 400,000 small businesses have permanently closed since the beginning of the pandemic and, nationwide, revenues are down by nearly a third.5

Renters and landlords — $25 billion in rental assistance for both renters and small landlords, plus $5 billion to help pay for residential utilities.6

Vaccine distribution — $160 billion for vaccine development and distribution, including $20 billion for states, localities, tribes and territories to create community vaccination centers and mobile units to inoculate people who live in remote areas.7

Americans who buy individual health insurance — $34.2 billion for additional health care subsidies. An additional $7.8 billion will be used to subsidize COBRA premiums for former employees.8

Tax Considerations

None of the personal stimulus checks issued by the federal government will be taxed as income. While unemployment benefits have historically been taxable, the bill excludes $10,200 in benefits from reportable income on 2020 tax returns, applicable only to households that earn less than $150,000 a year.9

Budget Reconciliation

The new legislation includes a trio of tax increases, which were necessary to comply with Senate rules for using the budget reconciliation measure — which requires provisions to help pay for the bill. The following tax increases included in the stimulus plan, valued at about $60 billion, attracted little political controversy because they are considered arcane:10

- A provision that eliminates deductions for publicly traded companies that pay top employees more than $1 million; expected to generate $6 billion.

- The repeal of a provision that allows multinational companies accounting flexibility for reporting interest expenses; expected to produce $22 billion.

- Extension for another year of the suspension of the $500,000 limit on losses reported by unincorporated businesses to offset income and reduce their tax bills; expected to raise $31 billion.

Investment Prospects

According to investment commentators at UBS Global Wealth, money from the new stimulus package is likely to flow into cyclical areas of the market. This means investors with holdings in financials, industrials and energy may benefit from higher growth and a steeper yield curve.11 As vaccine distribution becomes more widespread, the economy will continue to reopen, with more consumers out and about spending money at places like airlines, hotels and other industries battered by the pandemic. Some of that cash will pour into entertainment activities, such as movie theaters and video games, which could mean another round of activity with the likes of GameStop and AMC. The resurgence of these types of undervalued stocks may lead to a rotation out of “momentum” stocks, which thrived during the pandemic.12

The expansion of tax subsidiaries supporting state and federal health insurance exchanges will likely inject more cash into health insurance companies. That’s good news for private insurers like Aetna, Anthem, Cigna and Humana, which all benefited from the passage of the Affordable Care Act (Obamacare). Thanks to advances emanating from the pandemic, telehealth and technology- enabled health care firms are likely poised to benefit as well.13

It’s also worth noting that above and beyond direct stimulus checks, enhanced unemployment benefits will be used to pay for food, medication and rent. This is expected to drive consumer staples like Amazon, Costco and Walmart, as well as discount-dollar stores and fast-food chains.14

Global Impact

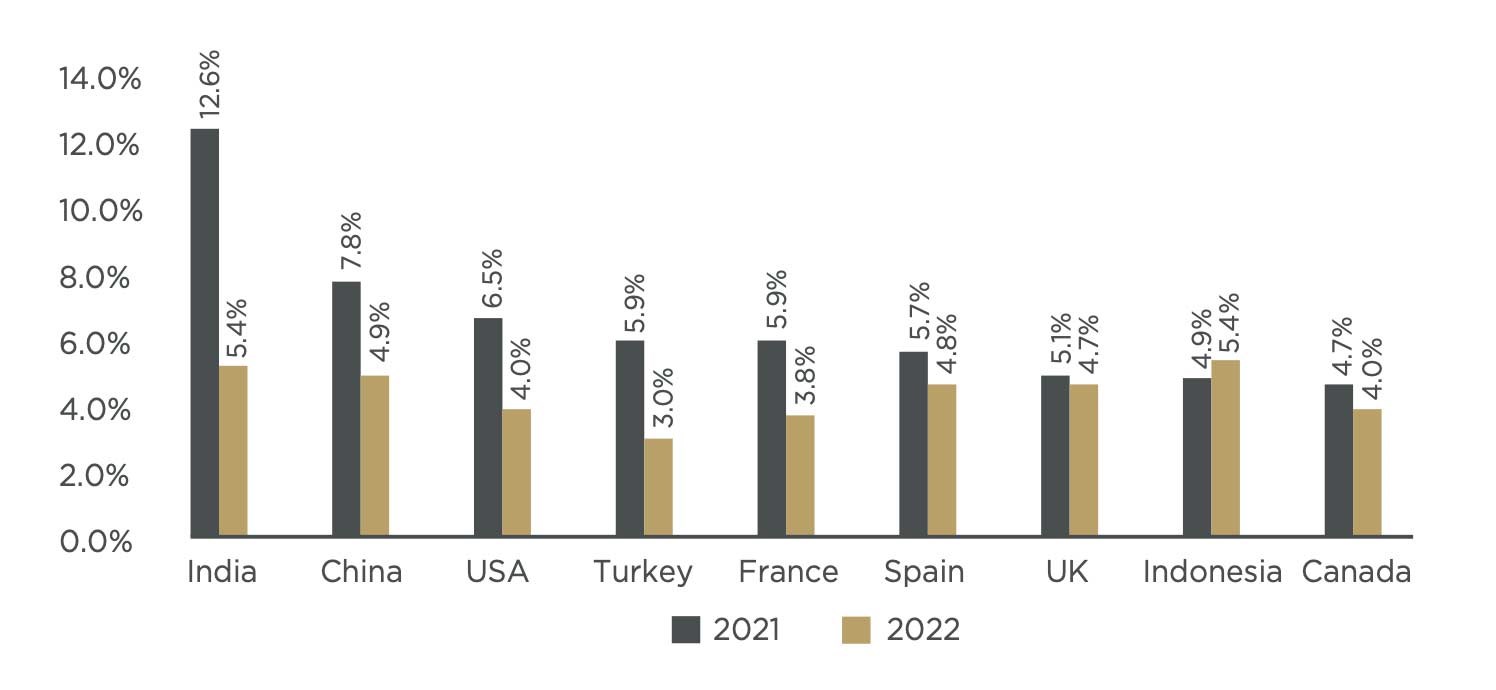

Global economists believe the recent stimulus, paired with broadscale vaccine distribution, will not only turbocharge a U.S. recovery, but also drive economic recovery worldwide. After passage of the new bill, the Organisation for Economic Cooperation and Development (OECD) updated its forecast for global output to surpass pre-pandemic levels by the middle of this year. The OECD doubled its 2021 expectation for U.S. growth to 6.5%, and increased overall world growth to 5.6% from 4.2%.15

“This will not only boost the U.S. economy, but it will fuel global growth through increased demand in the U.S. and from the U.S. to the rest of the world.”16

Real GDP Growth on Tap: Top Country Projections for 2021 and 202217

Final Thoughts

The stimulus bill is designed to do more than just help out those who are struggling financially. Doling out money to households with the luxury of considering it excess funds is designed to increase consumer spending in a variety of sectors. Higher business revenues should help strengthen company bottom lines, encourage growth and job development, and enrich shareholder value.

So, yes, more stimulus money will add to the nation’s debt. But strong economic growth can help offset that via higher sales, income, property and capital gains taxes. It’s like that old saying: You have to spend money to make money. While the Tax Cuts and Jobs Act of 2017 also was designed to be largely paid for via higher economic prosperity, it is possible that a cash-in-hand strategy may be more effective than an incremental income tax deduction to motivate spending. So whether you buy that Jet Ski for summer fun or donate your stimulus money to charity for a tax deduction, make sure someone benefits. If you’re thinking of contributing more to your retirement income plan, we love that idea. Even if you can’t control America’s financial future, you can take control of your own.

1 Jenn Underwood. Forbes Advisor. March 18, 2021. “Here’s Who Is Eligible For The third Stimulus Checks.” https://www.forbes.com/advisor/personal-finance/who-is-eligible- for-the-third-stimulus-check/#:~:text=Since%20the%20maximum%20income%20 threshold,the%20phase%2Dout%20limits%20above. Accessed March 23, 2021.

2 Ibid.

3 Ken Berry. CPA Practice Advisor. March 10, 2021. “Biden Signs Stimulus Bill into Law.” https://www.cpapracticeadvisor.com/tax-compliance/news/21213724/biden-signs- stimulus-bill-into-law. Accessed March 15, 2021.

4 Phyllis W. Jordan. FutureEd. March 18, 2021. “What Congressional Covid Funding Means for K-12 Schools.” https://www.future-ed.org/what-congressional-covid-funding-means- for-k-12-schools/. Accessed March 23, 2021.

5 Ledyard King and Javier Zarracina. USA Today. March 10, 2021. “President Joe Biden’s COVID stimulus bill explained in 6 charts.” https://www.usatoday.com/ in-depth/news/2021/03/10/covid-19-stimulus-bill-joe-bidens-plan-explained-6- graphics/4601454001/. Accessed March 15, 2021.

6 Ibid.

7 Ibid.

8 Maureen Groppe. USA Today. March 2, 2021. “Biden’s COVID-19 relief bill includes an expansion of Obamacare. Here’s how it would work.” https://www.usatoday.com/ story/news/politics/2021/03/02/covid-stimulus-package-includes-major-expansion- obamacare/4560965001/. Accessed March 23, 2021.

9 Ken Berry. CPA Practice Advisor. March 10, 2021. “Biden Signs Stimulus Bill into Law.” https://www.cpapracticeadvisor.com/tax-compliance/news/21213724/biden-signs- stimulus-bill-into-law. Accessed March 15, 2021.

10 Brian Faler. Politico. March 10, 2021. “A $60 billion surprise in the Covid relief bill: Tax hikes.” https://www.politico.com/news/2021/03/10/covid-relief-bill-tax-hikes-475051. Accessed March 15, 2021.

11 Palash Ghosh. Forbes. March 15, 2021. “Amazon, Six Flags, Square: Here Are The Stocks Ready To Rise Thanks To New Stimulus Checks.” https://www.forbes.com/sites/ palashghosh/2021/03/15/amazon-six-flags-square-here-are-the-stocks-ready-to-rise- thanks-to-new-stimulus-checks/?sh=2ebd86071a29. Accessed March 15, 2021.

12 Ibid.

13 John Hyatt. Nasdaq. March 12, 2021. “What Biden’s $1.9T Stimulus Means for Investors.” https://www.nasdaq.com/articles/what-bidens-%241.9t-stimulus-means-for- investors-2021-03-12. Accessed March 15, 2021.

14 Palash Ghosh. Forbes. March 15, 2021. “Amazon, Six Flags, Square: Here Are The Stocks Ready To Rise Thanks To New Stimulus Checks.” https://www.forbes.com/sites/ palashghosh/2021/03/15/amazon-six-flags-square-here-are-the-stocks-ready-to-rise- thanks-to-new-stimulus-checks/?sh=2ebd86071a29. Accessed March 15, 2021. 15 William Horobin. Bloomberg. March 9, 2021. “U.S. Stimulus Set to Turbocharge World Economy as Europe Lags.” https://www.bloomberg.com/news/articles/2021-03-09/u-s- stimulus-set-to-boost-global-economy-as-europe-lags-behind. Accessed March 15, 2021.

16 Ibid.

17 OECD. March 2021. “OECD Economic Outlook, Interim Report.” https://www.oecd.org/ economic-outlook/. Accessed March 15, 2021.

This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. Neither AE Wealth Management nor the firm providing you with this report provides tax or legal advice, and all individuals are encouraged to seek the guidance of a qualified tax and legal professional prior to making any decisions regarding their personal situation.

None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. Neither AEWM nor the firm providing you with this report is affiliated with or endorsed by the U.S. government or any governmental agency. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Investment advisory services offered only by duly registered individuals through AE Wealth Management, LLC. The advisory firm providing you this report is an independent financial services firm and is not an affiliate company of AE Wealth Management, LLC. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. The information and opinions contained herein provided by third parties have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by AE Wealth Management. This information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security or insurance product.