Markets tumble in wake of negative headlines

Hurricane Ian barreled through Florida this week, leaving a wide swath of destruction in its wake. A natural disaster of this magnitude is a negative...

Hurricane Ian barreled through Florida this week, leaving a wide swath of destruction in its wake. A natural disaster of this magnitude is a negative...

The Fed met on Tuesday and Wednesday. Expectations last week were for it to raise rates another 50 basis points (bps) and for the Fed Funds rate to...

It’s been another week of “up one day and down the next” for U.S. markets. In a major about-face following a 437-point rally on Tuesday...

Overview

Scientists attribute extreme weather events all over the world to a global warming trend. Since the late 19th century, the average...

The theory of diversification is that by spreading out invested assets among a wide variety of holdings, an investor can help reduce...

The American Jobs Plan (AJP) recently proposed by President Biden is composed of $2.7 trillion in expenditures and $2.1 trillion in...

Obviously, managing money as part of a partnership is vastly different than doing so for oneself. Even more challenging is the need...

In early March, President Joe Biden signed into law the third round of economic stimulus legislation passed by Congress, authorizing...

“Buy American” is a popular concept, both economically and politically. From the “Look for the Union Label”...

Are you thinking strategically about the possibility of higher taxes and their effect on your retirement assets? With Democrats controlling...

The stock market initially posted a major drop at the beginning of the U.S. coronavirus outbreak. Since then, it has gained back some...

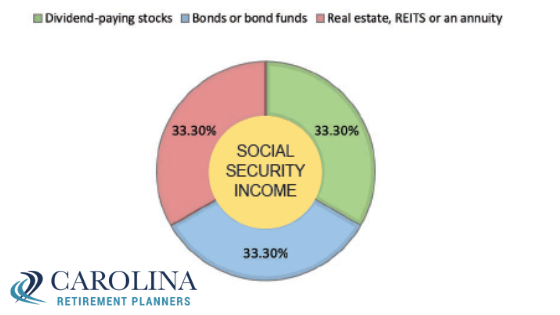

Investing for income is generally the modus operandi of a retirement portfolio. That’s because the so-called “accumulation...

The first quarter of 2020 started favorably. In early January, the news centered around politics, with the House sending...

Be sure to check out this special interview with an expert from the Johns Hopkins University School of Medicine about what seniors...

A diversified investment portfolio is generally composed of stocks, bonds and cash instruments. The percentage of how much money to...

We tend to get caught up in the day-to-day issues related to jobs, family and home projects. We plan vacations, we plan weddings, we...

On Dec. 20, 2019, President Trump signed into law the Setting Every Community Up for Retirement Enhancement (SECURE) Act as part of...

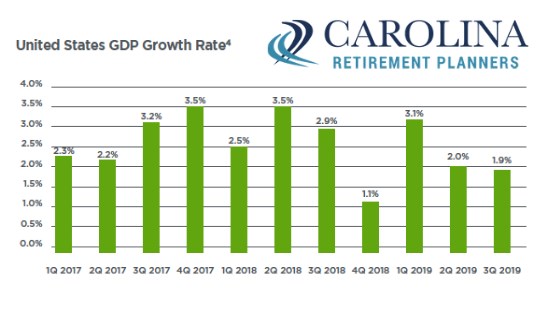

After a strong Q3, momentum continued throughout Q4 as we repeatedly hit new highs to close out the year. Q4 market drivers were the same we’ve...

There’s an app for seemingly every financial transaction or budgetary need consumers have. In fact, there are likely dozens if not hundreds from...

We approach the new year with indications of a potential economic decline in the near future. Given the continued strength of the economy...

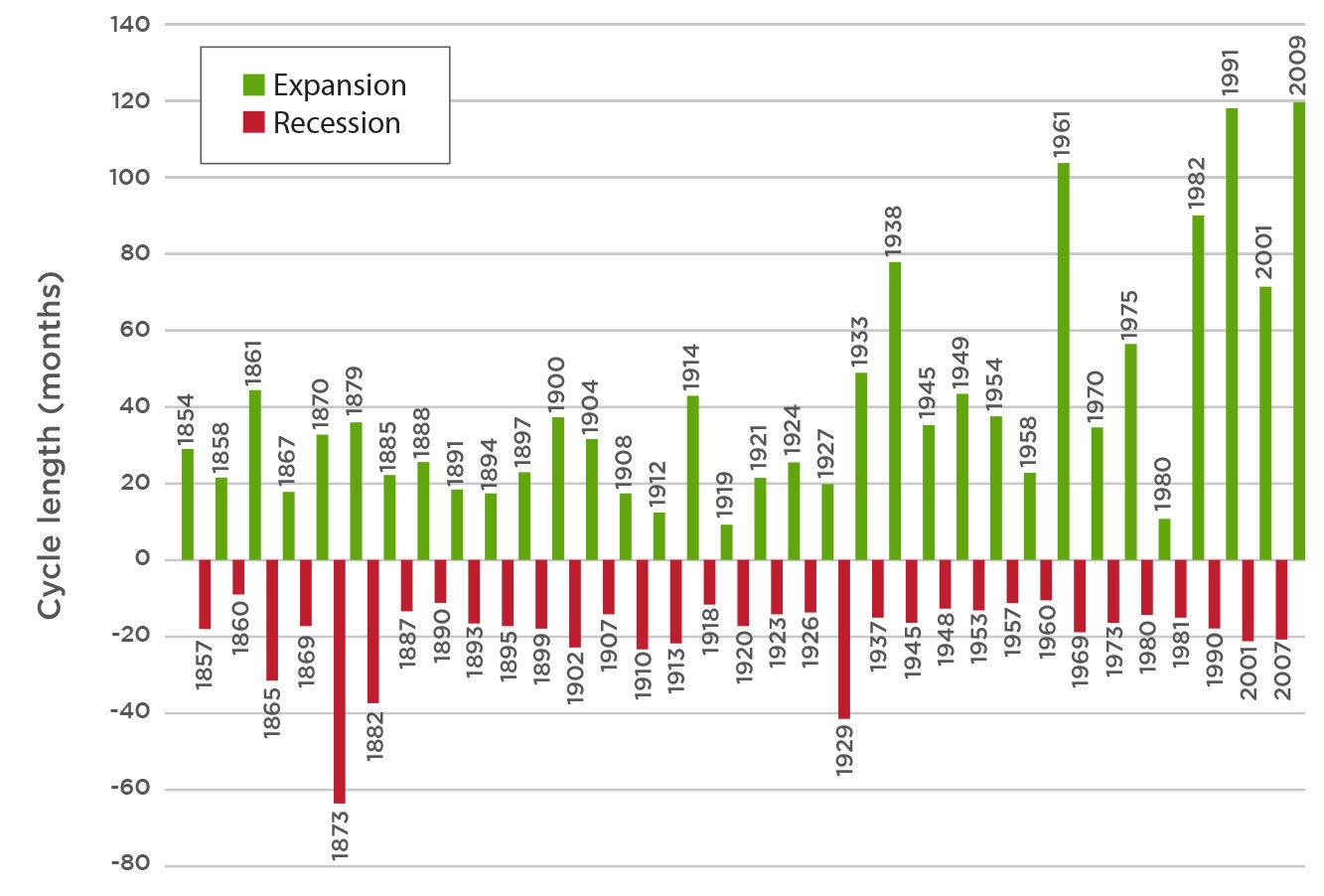

Technically, economists define a recession as a prolonged period of economic decline, often precipitated by two consecutive quarters...

In November 2007, Ben Bernanke, the Federal Reserve Chairman at the time, publicly announced inflation was likely to start inching...

As extreme weather events become more prevalent with each passing year, it’s worth examining the damage they can bring. In addition...

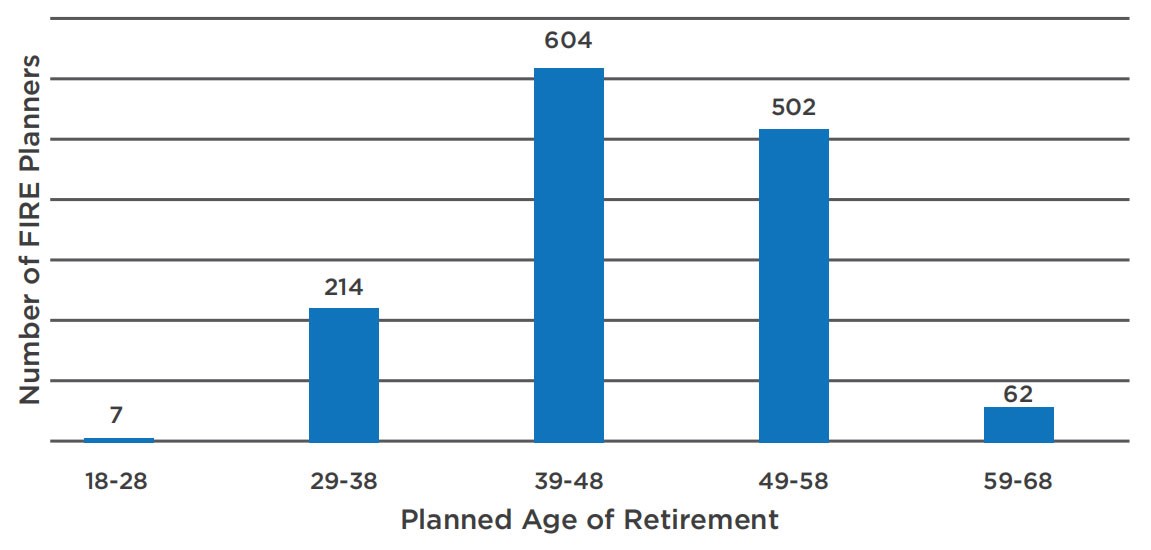

The message in today’s news and financial media is loud and clear: We are living longer, so we must work longer to save more. ...

Charitable giving is one of the oldest traditions practiced by mankind. The ancient Greeks believed philanthropy was fundamental to...

Remember the adage, “March comes in like a lion and goes out like a lamb”? It certainly held true for the market this year; we gently entered...

In May, the House of Representatives passed the Setting Every Community

Up for Retirement Enhancement Act of 2019 (SECURE Act) with...

A college degree is widely considered the necessary foundation for an upwardly mobile career and ensuing lifestyle. But to pay the...

More than 40 million Americans serve as the primary caregiver for their aging parents, and this phenomenon isn’t just a moment...

On May 30, President Trump threatened new tariffs on all goods imported from Mexico. Effective June 10, the U.S. would levy a 5% tariff,...

During the economic decline of the recession, many households struggled as one or both breadwinners lost jobs. Even workers who managed to survive corporate...

More and more we hear the same stories of women living longer, being sicker and with less money to work with into retirement. Women are 80% more likely...

You worked, you saved, you planned. Now, after all that, it’s time to retire. This big change is both exciting and a little scary. If you’ve...

Life is a series of natural and spontaneous changes. Don’t resist them; that only creates sorrow. Let reality be reality. Let things flow naturally...

Do you ever make lists of all of the things you intend to do but haven’t quite gotten around to? Get back to the gym, go on that trip, start seriously...

The storm has ended, the floodwaters have receded, and now you are left to clean up the mess that Hurricane Florence left in its wake. Hurricane Florence...

Medical technology can now identify risk factors in the human body long before they impact your health

A medical revolution is underway—one...

Many successful families use trusts to minimize taxes, transfer wealth and protect assets from creditors and others. You may have already set up a trust,...

Distraction from the media, uncertainty or volatility in the markets, or pressure to buy and sell from friends, colleagues, financial “gurus”...

A key objective among many single-family offices serving Super Rich families (those with a net worth of at least $500 million) is to enable future generations...

In our 30+ years in Wilmington, my wife, Sandy, and I have seen mind-boggling changes in the area as it has grown — some good,...

The Super Rich (those with a net worth of $500 million or more) who have family offices typically engage a sizable lineup of professional advisors to...

Imagine yourself in a vintage tuxedo, sipping a “shaken, not stirred” martini as you make eye contact across the bar with a beautiful secret...

There was a time when people looked forward to retirement as a time for relaxation. But planning for the financial future is anything but relaxing for...

Chances are, you know someone who has been sued. Maybe that someone...

So, you’ve crafted a plan for how you want your wealth, possessions and other assets to be distributed after you die. But what happens to your...

David has relinquished his writing privileges this month to me, his wife, Sandy. He’s nursing a little headache right now, bless his heart, for...

Compromise is a key component in any happy marriage. It gets couples through the many roadblocks that life places in the path of a long-term, committed...

My wife, Sandy, and I sat huddled in the dark; the wind outside howled as if a freight train was going by. It was the fall of 1984, our first hurricane...

As a parent and a financial advisor, it has always been important to instill the value of financial knowledge and to encourage other parents to teach...

© Copyright 2025.

Carolina Retirement Planners. All Rights Reserved.

Website & Hosting by BlueTone Media